Green Minerals among Europe’s top-performing listings in 2021

BLOOMBERG NEWS

Mar 26, 2021 13:35:42

Newest Battery-Metal IPO Taps Rising lnterest in the Deep Sea

- Green Minerals among Europe’s top-performing listings in 2021

- Company targets cobalt, copper on Norwegian continental shelf

By Jonathan Tirone

(Bloomberg) — Rising investor demand for ethically-sourced battery metals opened the window this week for Norwegian seafarers to become the first deep-sea mining stock publicly offered.

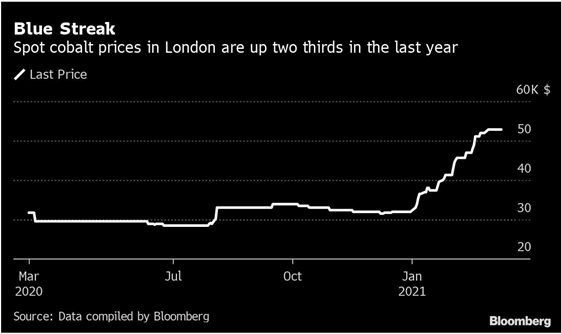

Norway’s Green Minerals AS says it will be able to exploit the cobalt and copper needed by electric vehicles without inflicting damages on people and the environment. Most current production comes from loosely-regulated mines in Democratic Republic of Congo. Green Minerals joins a growing list of companies that want to dean up supply chains by mining the deep sea.

«There isn’t as much conversation in the green community about what comes before the final product, the resources required for batteries, panels and windmills,» Green Minerals Chairman Staale Rodahl said in an interview. The company is among Europe’s 10 best initial public offerings this year after more than doubling its value following Tuesday’s listing on the Euronext Growth market in Oslo.

Investor interest in deep sea minerals is rising ahead of an mining code of conduct that’s expected to be concluded this year by the International Seabed Authority, which has already entered into more than two dozen exploration contracts around the world. The Sustainable Opportunities Acquisition Corp., a blank-check company, generated about $570 million cash to pursue seabed mining by teaming up with DeepGreen Metals Inc.

Green Minerals figures the continental shelf between Norway and Greenland contains minerals worth

$77 billion, including almost 7 million tons of cobalt-rich copper. The company is using funds to hire scientists and develop underwater mining technologies with the U.K.’s Oil States Industries Ltd.

Licenses are expected to be granted by 2023 with first production seen mid-decade.

After raising funds in a private placement last year, Green Minerals is currently valued at about $38 million. Seabird Exploration Plc, the seismie-data collector that spun off the company, remains the company’s biggest shareholder.

The key to unlocking the deep sea industry will be to ensure that seabed activities result in significantly lower environmental impacts than land-based mining, according to Rodahl, who added that Green Minerals is taking part in research voyages over the next two years.

«We expect to see the strietest environmental standards in the world,» the executive said.

© 2021 Bloomberg L.P. All rights reserved.

BLOOMBERG NEWS

To contact the reporter on this story:

Jonathan Tirone in Vienna at jtirone@bloomberg.net